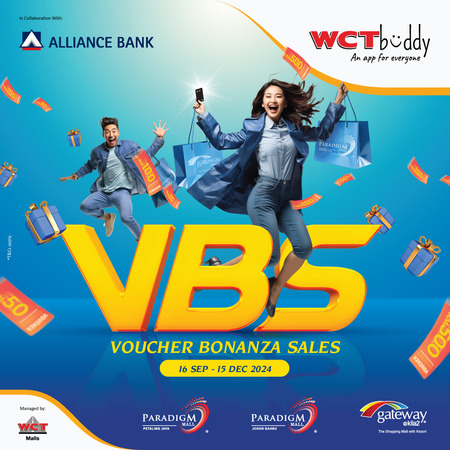

Voucher Bonanza Sales 16.0

Event Details

16 Sep 2024 - 15 Dec 2024

10AM - 10PM

10AM - 10PM

WCT Buddy members who spend RM200 or more in total using an Alliance Credit Card and upload their receipts on the same day of purchase via the WCT Buddy App, with verification by Customer Service at the Concierge Counter between 16 September 2024 and 15 December 2024, are eligible for a 20% discount on WCT Malls E-Vouchers when purchasing from the E-Shop in the WCT Buddy App using any Alliance Credit Card.

Location

gateway@klia2

Paradigm Mall PJ

Paradigm Mall JB

WCT Malls

Terms & Conditions

1. The “WCT Mall Voucher Bonanza Sales Credit Card Usage Campaign” (“Campaign”) is organised by Alliance Bank Malaysia Berhad (“Bank”) and WCT Malls and shall run from 16 September 2024 to 15 December 2024 (both dates inclusive) or such other time period as may be notified by the Bank from time to time (“Campaign Period”). By participating in this Campaign, the Eligible Cardholders (as defined hereunder) shall have thoroughly read and fully understood all the Terms and Conditions herein and fully agree to be bound by and accept all the Terms and Conditions.

CAMPAIGN DETAILS

2. This Campaign is open to:

i. All new and existing Alliance Bank Credit Cardholders (“Eligible Cardholders”) whose Credit Card is valid, and payment can be made at the point of transaction during the Campaign Period, as may be determined by the Bank as per the Bank’s internal policies and;

ii. WCT Buddy members (“Members” or “Buyers”). Only members of the WCT Buddy App are allowed to purchase the WCT Malls E-Vouchers (“Vouchers”) available for sale during the Campaign Period.

3. For avoidance of doubt:

i. Termination of the Supplementary Card account by the Supplementary Cardholders shall not disqualify its Principal Cardholder from this Campaign.

4. The following individuals shall NOT be eligible to participate in this Campaign:

i. Non-Alliance Bank Credit Cardholder

ii. Cardholders of any Business Credit Cards;

iii. Cardholder(s) whose account(s) with the Bank are dormant, inactive, closed, terminated and/or unsatisfactorily conducted;

iv. Cardholder(s) who are deceased, or persons who have legal proceedings of any nature instituted against them;

v. Persons who are of unsound mind, minors or bankrupts;

vi. Any other persons as may be determined by the Bank to exclude according to internal policy(ies).

vii. Any other person(s) as the Bank may decide to exclude as per the Bank’s internal procedure.

5. Campaign participation is automatic for the Eligible Cardholders subject to the fulfillment of the Terms and Conditions herein. No SMS registrations or entry forms are required.

CAMPAIGN MECHANICS AND REWARDS

6. To participate in this Campaign, the Eligible Cardholders must download the WCT Buddy loyalty programme mobile application (“WCT Buddy App”) and sign up as WCT Buddy.

7. Eligible Cardholder must make a minimum spend of RM200 (“Eligible Transaction”) at Paradigm Mall Petaling Jaya, Paradigm Mall Johor Bahru or gateway@klia2 with a valid Alliance Bank Credit Card in a maximum of 3 combined same-day receipts.

8. Eligible Cardholders are required to approach the Customer Service at Paradigm Mall Petaling Jaya, Paradigm Mall Johor Bahru or gateway@klia2 on the same day of the purchase for verification of the spend, present the receipt(s) and the Alliance Bank Credit Card used for the transactions as proof, upload the receipts into the WCT Buddy App to be eligible to purchase the 20% E-Voucher under the Voucher Bonanza Sales campaign.

9. Eligible Cardholders are allowed to start spending the minimum amount of RM200 from 14 September 2024. However, the E-Voucher redemptions via the WCT Buddy App will start from 16 September 2024 onwards.

10. Eligible Cardholders are entitled to purchase a minimum of RM200 and a maximum of RM2,000 total worth of WCT Malls E-Vouchers at a 20% OFF per cardholder per campaign month, and up to RM6,000 total worth of E-Vouchers per cardholder per campaign period on the E-Shop in the WCT Buddy App (“E-Shop”) using a valid Alliance Bank Credit Card.

11. The denomination(s) of the E-Vouchers are available in RM5, RM10, RM50, RM100 and RM500 and shall be determined by WCT Mall at its sole and absolute discretion.

12. All E-Vouchers are available while stocks last from 16 September 2024 onwards and on a first come first served basis.

13. The WCT Buddy E-Vouchers redemptions are capped monthly, based on the table below:

Table 1: WCT Buddy E-Vouchers Redemption Capping

| Campaign Month | Total E-Voucher Value Worth | Total Redemptions Capped Per Month |

| 16th September 2024 – 15th October 2024 | RM 300,000 | 150 |

| 16th October 2024 – 15th November 2024 | RM 300,000 | 150 |

| 16th November 2024 – 15th December 2024 | RM 200,000 |

100 |

14. The Eligible Cardholders or members of WCT Buddy must make payment for the E-Vouchers in accordance with the terms stipulated by WCT Malls E-Shop Sdn Bhd or its affiliates (“WCT” or “we” or “us”) and comply with all other terms and conditions in respect of the Campaign as may be stipulated by WCT Mall.

15. The Eligible Cardholders or members of WCT Buddy eligibility for purchase of the E-Vouchers as well as the issuance of the E-Vouchers to the members’ WCT Buddy account will be verified and processed by WCT Buddy within three (3) working days (Mondays to Fridays between 9:00a.m. to 6:00p.m., excluding Saturdays, Sundays and public holidays) from the date of the E-Vouchers purchase. A push notification from the WCT Buddy App will be sent to the eligible cardholders once the E-Vouchers have been credited into their WCT Buddy accounts.

16. In the event the Eligible Cardholder or members of WCT Buddy pays a sum exceeding RM2,000 worth for the E-Vouchers, WCT Mall will refund the entire payment by bank transfer to the Eligible Cardholder or members within ten (10) working days. The eligible cardholder is required to re-purchase the E-Vouchers via the WCT Buddy App. The allowable limit is capped at RM2,000 worth of E-Vouchers.

17. In the event the Eligible Cardholder or members of WCT Buddy makes payment for the E-Vouchers without fulfilling the terms and conditions in Clauses 7 prior to the purchase of the E-Vouchers upon the verification pursuant to Clause 8 hereinabove, WCT Mall will refund the payment via the E-Shop or bank transfer to the Eligible Cardholder or member within ten (10) working days, less such administrative charges of 2% which shall be paid to WCT Mall.

Illustration of the 20% OFF E-Voucher Bonanza Sales

Scenario A: Customer met the criteria

Eligibility to redeem E-Voucher: Yes

Customer A spent RM500 on 2 receipts at Paradigm Mall PJ with an Alliance Bank Credit Card. Customer A proceeds to Customer Service for validation of the spending by presenting the receipts and the Alliance Bank Credit Card used for the purchase. Customer A is eligible to purchase the WCT E-Voucher at 20% OFF via the WCT Buddy App. Customer A makes a purchase of RM2,000 worth of E-Voucher at a discounted price of RM1,600.

Scenario B: Customer spent with non-Alliance Bank Credit Card

Eligibility to redeem E-Voucher: No

Customer B spent RM200 on 1 receipt at Paradigm Mall JB with a non-Alliance Bank Credit Card. Customer B proceeds to Customer Service for validation of the spending by presenting the receipts and the non-Alliance Bank Credit Card used for the purchase. Customer B is not eligible to purchase the WCT E-Voucher at 20% OFF as the customer did not fulfill Clause 7 of spending with an Alliance Bank Credit Card.

Scenario C: Customer did not meet the minimum spend of RM200

Eligibility to redeem E-Voucher: No

Customer C spent RM100 at gateway@klia2 with an Alliance Bank Credit Card. Customer C proceeds to Customer Service for validation of the spending by presenting the receipts and the Alliance Bank Credit Card used for the purchase. Customer C is not eligible to purchase the WCT E-Voucher at 20% OFF as the customer did not meet the minimum spending requirement.

Scenario D: E-Voucher value purchased exceeded the capping of RM2,000

Eligibility to redeem E-Voucher: No

Customer D purchased RM3,000 worth of E-Vouchers in the month of October. As pursuant to Clause 10, the total worth of E-vouchers allowed to be purchased is capped at a total worth of RM2,000 per cardholder per campaign month. Customer D has exceeded the capping amount for the particular month and is not allowed to purchase the E-Vouchers. With this, WCT Mall will refund the entire payment to the customer. Customer is required to re-purchase the E-Vouchers.

Refund amount: RM3,000 – 20% (RM600) = RM2,400. Hence the total that will be refunded to Customer D is RM2,400.

18. The E-Vouchers are applicable for usage at participating retail outlet(s) at Paradigm Mall Petaling Jaya, Paradigm Mall Johor Bahru or gateway@klia2 (“Participating Merchants”) excluding goldsmith shops (for example, Poh Kong, Tomei, Wah Chan, MJ Jewellery etc.). The list of Participating Merchants can be found at the respective retail malls’ website:

a. Paradigm Mall Petaling Jaya (https://paradigmmall.com.my/)

b. Paradigm Mall Johor Bahru (https://paradigmmall.com.my/jb/)

c. Gateway@KLIA 2 (https://gatewayklia2.com.my/)

19. All Vouchers shall have a validity period of four (4) months from the date of issuance thereof. There shall be no extension whatsoever to such validity period unless otherwise subsequently informed by WCT Mall or WCT Buddy.

20. This Campaign is not applicable in conjunction with any other on-going promotions or campaigns of the Bank unless otherwise stated.

21. There shall be no cancellation of the purchase of the E-Vouchers, exchange of the E-Vouchers with cash or other items or change of the E-Vouchers denomination on the part of the Buyer once payment has been received by WCT Mall.

22. There shall be no refund of payment whatsoever once the E-Vouchers appears in the Eligible Cardholder or members of the WCT Buddy account, unless the circumstances in Clause 21 hereinbelow arises.

23. WCT Mall and WCT Buddy reserve the rights to amend the terms and conditions herein and in relation to the Campaign without prior notice. Please email wctbuddy@wctmalls.wct.my or enquire through chat via WCT Buddy WhatsApp support line: +6011- 2552 0771 (between 9:00a.m. to 6:00p.m. during office hours only) if any assistance or enquiry is required.

GENERAL TERMS AND CONDITIONS

24. By participating in this Campaign, Eligible Cardholders are required to read, and understand the terms provided before agreeing to the Campaign Terms and Conditions. This Campaign Terms and Conditions and the Bank’s decision on all matters relating to this Campaign shall be final and binding on all Cardholders and no correspondences and/or appeal in respect thereof shall be entertained.

25. The Bank reserves the right to withdraw/ cancel, terminate, suspend or extend this Campaign and to add, delete, suspend and/ or vary this Campaign Terms and Conditions, wholly or in part at its discretion with prior notice by way of posting on The Bank’s website, display at branch premises or advertisements or by any other means of notification which The Bank may select and such shall be binding on the Eligible Cardholders as from the date of the notification or from such other date as may be specified by The Bank in the notification. Eligible Cardholders hereby agree to access The Bank’s website at regular intervals to view this Campaign Terms and Conditions.

26. The Bank reserves the right to change or substitute at any times, at its own discretion as per the bank’s internal policies, the Campaign Reward with other item(s) or reward(s) of similar value with prior notice via the bank’s website.

27. The Campaign Terms and Conditions shall be supplemental to the existing terms and conditions governing the Cardholder’s Product and banking accounts maintained with the Bank (“the Existing Terms”).

28. The Campaign Terms and Conditions and The Bank’s decision on all matters relating to this Campaign shall be final and binding on all Eligible Cardholders and no correspondences and/ or appeal in respect thereof shall be entertained.

29. The Bank shall not be responsible nor shall accept any liabilities of whatsoever nature howsoever arising or suffered by Eligible Cardholders resulting directly or indirectly from this Campaign due to cardholders own action. The Bank shall not be liable or held responsible to the Eligible Cardholders in any manner whatsoever if The Bank is unable to perform any of its obligations under this Campaign directly or indirectly due to any force majeure event which include but not limited to any act of God, war, strike, riot, industrial dispute, lockout, fire, drought, flood, storm or any event beyond the reasonable control of The Bank.

30. The Bank shall not be responsible for any technical failures of any kind, whatsoever intervention, interruption, electronic error and/ or any failure or delay in the transmission of evidence of transactions by Visa International, merchant establishments, postal or telecommunication authorities or any other party which may affect the Eligible Cardholder’s entitlement during the Campaign Period.

31. The Eligible Cards and accounts of the Eligible Cardholders’ must at all times (i) be valid, in good credit standing and not be in breach of any terms of this Campaign Terms and Conditions or the Existing Terms; and (ii)not be terminated or closed or be made subject to any attachment, adverse orders made by Court or any authorities sanctioned by laws, delinquent and/ or invalid or cancelled as may be determined by The Bank in order to be entitled for the Campaign Reward.

32. The Bank reserves the right to disqualify the participation of any Eligible Cardholders or forfeit the Campaign Reward in circumstances where there is a fraudulent, unauthorised or reversal of transaction(s) or breach or potential breach of these Campaign Terms and Conditions as per ABMB internal policies. All records of The Bank on the transaction(s) made shall be conclusive and final.

33. For the avoidance of doubt, any cancellation, termination, suspension or extension of this Campaign or disqualification of the Eligible Cardholders or forfeiture of the Campaign Reward shall not entitle the Eligible Cardholders to any claim or compensation against The Bank or for any and all losses or damages suffered by the Eligible Cardholders as a direct or indirect result of the act of cancellation, termination, suspension, extension, disqualification or forfeiture due to the Eligible Cardholders own act.

34. Eligible Cardholders shall be personally responsible for all taxes, rates, government fees or any other charges that may be levied against them under applicable laws, if any, in relation of this Campaign.

35. Eligible Cardholders hereby give their unequivocal and irrevocable consent and authorise ABMB to use, publish and/ or display the names, any photographs taken, any videos recorded and/ or other information for advertising and/ or promotion limited to this campaign only, without any compensation to the Eligible Cardholders.

36. By participating in this Campaign, the Eligible Cardholders agree that they have read the Notice and Choice Principle Statement available at the Bank’s website (https://www.alliancebank.com.my/Notice-and-Choice-Principle-Statement-Personal-Data-Protection-Act-2010) and hereby give their consent and authorise the Bank to disclose their particulars to any third party service provider engaged by the Bank for the purpose of this Campaign.

37. The Bank has instituted and maintains policies and procedures designed to prevent bribery and corruption by the Bank and its directors, officers, or employees; and to the best of the Bank’s knowledge, neither the Bank nor any director, officer, or employee of the Bank has engaged in any activity or conduct which would violate any anti-bribery or anti-corruption law or regulation applicable to the Bank. The Bank has not, and covenants that it will not, in connection with the conduct of its business activities, promise, authorise, ratify or offer to make, or take any act in furtherance of any payment, contribution, gift, reimbursement or other transfer of anything of value, or any solicitation, directly or indirectly to any individual.

38. By virtue of participating in this campaign, Eligible Cardholders hereby acknowledges that it has been made aware of the Bank’s anti-bribery and corruption summary of the policy available at https://www.alliancebank.com.my/Anti-Bribery-and-Corruption-Summary-of-Policy.aspx and further covenants/undertakes that it shall not indulge in such corrupt practices in whatsoever manner whether directly or indirectly with any directors, officers or employees of the Bank.

39. For Visa Cardholders with card types shown in the Table A below, Visa is offering E-Commerce Purchase Protection & Extended warranty as a benefit to provide added protection and peace of mind to cardholders when shopping online.

Table A:

| Program Date: | 1 October 2023 – 30 September 2024 |

| Card Types: | Visa Signature & Visa Infinite (Consumer Credit only) |

| Benefits: | eCommerce Purchase Protection | Extended Warranty |

| Offer Details: |

eCommerce Purchase Protection will provide different coverage per annum for different product tiers:

• Visa Signature cardholders are covered up to USD 200 per claim, up to a limit of USD 200 per annum

• Visa Infinite cardholders are covered up to USD 200 per claim, up to a limit of USD 200 per annum

eCommerce Purchase Protection provides coverage for possible losses from online purchases, which includes:

• Non-delivery and/or incomplete delivery of purchased items

• Malfunctioning of delivered item due to physical damage at time of delivery

|

Extended Warranty duplicates the terms of the original Manufacturer’s Warranty up to 1 full year and covers repair or replacement of products due to mechanical breakdown that renders the article unfit for its intended purpose after the initial warranty of the product has expired, conditions include:

• Purchases must have a minimum of 12 months manufacturer’s warranty

• Purchases given as gifts are covered

• Covered Purchases include internet purchases

• Covered Purchases do not have to be registered

|

40. For more details on the Visa E-Commerce Purchase Protection and Extended Warranty, please refer to the https://www.visa.com.my

PREVENTION AND MITIGATION OF BANKING FRAUD AND SCAM

41. The Bank may from time to time provide the latest update or content to educate the Eligible Cardholders and create awareness that help prevent or mitigate fraud and scam risk. These may include but not limited to security tips, software/operating system/application/version update, and regulation requirements from any relevant governing bodies.

42. The Eligible Cardholders shall keep in safe custody of all banking instruments, for example cheque books/cheque leaves, security tokens, debit card, telephone banking PIN, internet and mobile banking login credentials, and transaction authorisation code (TAC). The Eligible Cardholders shall notify the Bank immediately when the Eligible Cardholders becomes aware that any of the above is lost or used without authority or proper authorisation. The Eligible Cardholders shall not be liable for losses resulting from unauthorised transaction(s) occurring after the Eligible Cardholders had notified the Bank in accordance with these Terms and Conditions that the Eligible Cardholder’s banking instruments mentioned above have been lost, misused, stolen, compromised or breached.

43. Where any loss or damage suffered by the Eligible Cardholders is solely attributed to the wilful negligence of the Bank, the Bank’s sole and entire liability (whether in respect of one or more claims) to the Eligible Cardholders in contract or tort shall not exceed the amount of the transaction which gave rise to the claim or claims or the direct damages sustained, whichever is lower. In no event shall the Bank be liable or any loss of business, loss of profits, earnings or goodwill, loss of data, indirect, consequential, special or incidental damages, liabilities, claims, losses, expenses, disbursements, awards, penalties, proceedings and costs regardless of whether the possibilities of such losses or damages were disclosed to, or could have reasonably been foreseen by the Bank.

44. Upon being notified by the Eligible Cardholders of such incident, the Bank shall conduct an investigation and the Eligible Cardholders are required to provide sufficient information and collaboration to facilitate the investigation. The Bank is hereby given the authority to perform the following measures upon detection (with/without prior consent from customer) in order to prevent or mitigate further financial loss while the Bank is performing its investigation:

i. Suspend or freeze the affected account;

ii. Revoke or reset the Eligible Cardholders’ internet or mobile banking access; and/or;

iii. Revoke the validity of banking instruments; and the Eligible Cardholders will be notified once the above has been operated.